At the end of the year, the Auditor (of the investment company) will ask us to do a Financial Projection with the 10-year DCF Method to see what the current valuation is. To decide whether or not to impairment of assets, which will also affect the investor’s company account.

For those who want to read specific topics, you can click here.

Company Valuation of Investors vs. Entrepreneurs

DCF, or Discounted Cash Flow, is a number that represents the cheap value of an entity. Cash flow discounting is classified as absolute valuation, meaning the resulting figure is a complete figure in itself. It can indicate the value of an entity without necessarily comparing it with any other entity.

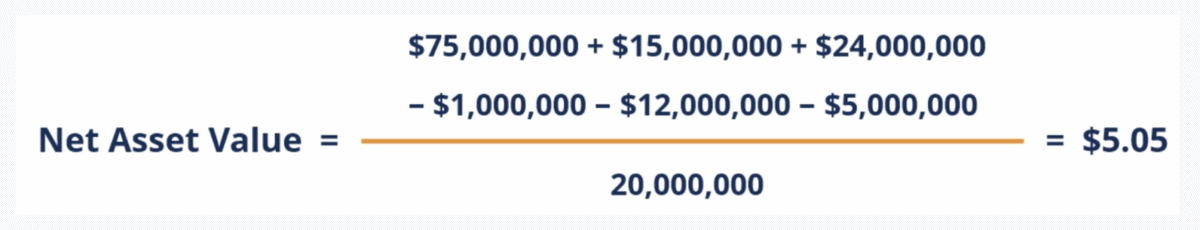

The 10-year DCF Financial projection was completed within 24 hours because it had to be sent to the Auditor, where the operators would calculate optimism, a bright future, growing up, and profiting beautifully in the future. And the asset impairment (in the investments that go into startup companies) is embarrassing for investors, so I think back to the days when I worked in investments, and the companies invested in startups around the world. At the end of the year, it will report its earnings to write-off (cut off from the account, the company is ruined). An additional 100 investment firms in the report will have a beautiful list of net asset value (NAV), Internal Rate of Return% (IRR), which tells how much the investment has gone down, grown, blossomed, and added.

Calculating Net Asset Value

When we delved deeper into the report, we found interesting terms such as Unrealized Capital Gain (gains resulting from increased company value but not yet realized/recognized as accounting income, because as long as it hasn’t actually been sold (or entered into the stock exchange), valuation is only a fictitious number, which is divided into three groups.

When we delved deeper into the report, we found interesting terms such as Unrealized Capital Gain (gains resulting from increased company value but not yet realized/recognized as accounting income, because as long as it hasn’t actually been sold (or entered into the stock exchange), valuation is only a fictitious number, which is divided into three groups.

- For companies where an IPO has entered the market, the valuation (called market cap) is very clear and transparent because it has clear value figures. Verifiable, stocks that are actually traded, liquidity or acquisition companies will also have clear trading figures.

- If a company that has not entered the market (private company) but has already raised a fund by a Trusted 3rd party investor, it will use the valuation that the investor has in the last round. If the value increases, it will be considered unrealized gain, which is a number that cannot be realized as accounting profit anyway. Because I don’t know if the company is actually buying, the buyer will actually pay this price, which may be more or less, or if someone will buy it.

- If the company has not raised the fund (add more After the fund has invested), the fund will calculate the fair market value to determine the present value of each company invested, which is to guess that someone must sit down for 10 years of Financial Projection (like we do now), and then use the resulting valuation figures to calculate IRR%, NAV to give investors in the fund peace of mind.

The inherent proportions are group 3, 2 less, and 1 rarely.

In short, Valuation is just an imaginary fictitious number of buyers and sellers (investors and entrepreneurs). If one believes that the future will be good (together), the numbers will be high. I think the future is bad. The numbers will also be low.

20% of companies without a future it is 0, while 1% shares of companies with bright futures could be hundreds of millions.

If you are interested in business valuation and due diligence services, you can see the details.All Our Services Or contact Plusitive Accounting via Line ID : plusitiveaccounting

Article by Mr. Saroj Adhivitvas Founder of Wisible, a sales management program for B2B businesses

Compiled by Plusitive Accounting Team.